Yes, if you would like to pay towards all or some of the options available, you can do so. You will need to pay a minimum of 3% into the ISA and/or Student Loan.

If you wish to select this you can do so by clicking here.

SAP will pay 9% into the pension. This happens whether:

- you opt to redirect your pension contributions to the ISA and/or Student Loan, or

- you choose to stay in the pension with a 5% contribution and also pay to one or both of the ISA and Student Loan. SAP makes no further contributions whichever of the above you select, except for any NI passback from your pension contributions.

When you join SAP, you’ll be automatically put into the SAP scheme. This is known as automatic enrolment, and is a legal requirement for all employers. Your automatic enrolment contribution rate is 3% of your basic salary, and SAP will pay 6% of your basic salary – this is the Pension Lite category.

If you wish to pay at the higher level of 5% of your basic salary, and get a 9% company contribution, you’ll need to log in to the flexible benefits system and either opt in to the pension (if you’ve not been automatically enrolled) or change your personal contribution level to 5% or more.

For full details of your SAP pension, please click here.

If you’re a new joiner, and want to benefit from one of the other ‘Saving Choices’ options (Student Loan or ISA) you’ll need to opt in to the pension within one month of joining SAP and complete the Savings Choices form.

Whether you contribute at the Pension Lite (3% – 4%), or Pension (5% or more) you will benefit from SAP’s NI passback so an additional 7% of what you pay will be added to the pension.

If you don’t want to be a member of the plan you can opt out. You will be notified of this as soon as you have been automatically enrolled. If you opt out within the opt-out period (which is 1 month from the date of you being notified of enrolment, either by SAP or your provider, Scottish Widows, which ever date is the later), your contributions will be refunded. The employer contribution will be refunded back to SAP.

You can still opt out of the pension scheme after the opt-out period, but in this case anything paid into the pension will continue to be invested until your retirement, or until you transfer it to a different plan.

If you opt out of the plan, you may be re-enrolled into the plan within three years. A notice will be sent to you at the time this takes place. You will of course have the option to opt out again.

It is important to note that if you opt out, you will no longer be saving for your future through the pension and SAP will not contribute to an alternative pension arrangement. You will therefore not receive the benefit of SAP’s pension contributions.

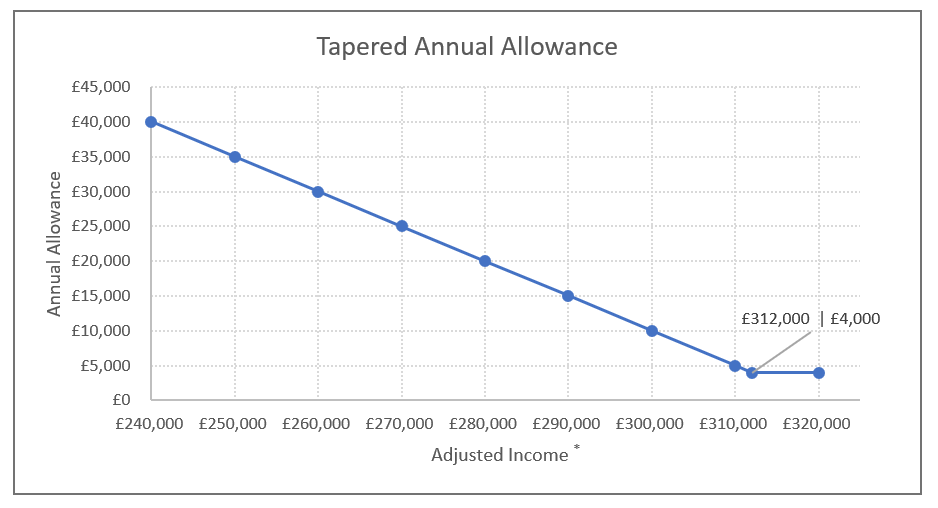

The Tapered Annual Allowance or TAA restricts the pension savings you can make if your adjusted income is over £240,000 per year. Your Annual Allowance will reduce by £1 for every £2 your adjusted earnings are above £240,000.

Adjusted income includes all taxable income including that from investments and also employer pension contributions. However, the Annual Allowance is unlikely to reduce if your salary is below £200,000. The graph below shows how the Annual Allowance will reduce as earnings increase:

* Remember that your Adjusted Income needs to include any contributions paid to your pension by both you and your employer

For more information about the Annual Allowance click here.

Some people may find that whilst they have paid in more to the pension in a tax year than their Tapered Annual Allowance (TAA) ‘allows’ they are able to avoid a tax charge by ‘mopping up’ unused personal allowances from the three previous tax years. You firstly need to decide if this affects you – see the guide for more information. If you find you have paid in more than your TAA, you will need to disclose this in your self-assessment, and there will likely be a tax liability (charge).

If you have calculated that you will be liable to additional tax on the standard SAP pension contributions, we offer alternative options. You can select one of these here on the You can select one of these here on the Savings Choices form.

-

Tapered Allowance of £10,000 and contributions to the pension maintained by you and the Company.

Your personal contribution is based on 5% of a capped salary of £68,500; SAP also give 7% of this in respect of their NI passback. SAP’s contribution of 9% of your basic salary is paid in but only so a total of @ £833 is paid in each month (made up from you, NI passback and SAP). The balance of the Company pension contribution is paid to you as a cash allowance less employer National insurance of 13.8%. The cash allowance is taxable as additional income.

If you want to pay in more to the pension you can do so by making a bonus sacrifice at the end of the year once your total adjusted income is known and you have calculated your own tapered allowance.

- If you are capped with a tapered annual allowance of £4,000 please contact the SAP helpdesk here.

- The third option is for people to utilise the Savings Choices

Here you can direct your personal contribution to the Corporate ISA (minimum 3% of gross salary but deducted from net pay) and SAP pay 9% of a capped salary of £110,000 to the pension. So £833 is paid to the pension. The balance of the SAP contribution is paid to you as a cash allowance as described above.

How do I transfer my existing pension arrangements? The first thing you need to do is clarify whether or not the transfer can be made, as you may not be able to transfer the benefits into your plan (although most existing pension arrangements can be transferred, but you do need to check first).

You will also need to find out whether any existing pension arrangement is part of an occupational scheme or personal pension scheme. If you’re not sure, you can either ask your previous employer (their HR department will know) or, if it’s an individual plan, you can ask the company managing your pension scheme (usually a GPP provider). Of course, if you have a professional financial adviser, the easiest route may be to ask them to obtain this information.

Once you’ve found out details of your existing plan, have a look at the ‘transfer in’ link on the pension page of the SAP flexible benefits portal (site only accessible from SAP network). This will give you information on what to consider, and there is an online process through Scottish Widows site to follow if you wish to proceed with the transfer.

Let’s look at an example where individual has a salary of £40,000.

They will pay:

3% into an ISA - £100 per month. This will be deducted from net salary (so after tax and National Insurance (NI) has been deducted).

5% into the pension - £166.66 per month. This will be deducted from gross salary (so before income tax and NI has been deducted). This is called salary sacrifice and means you automatically receive tax relief at your highest rate.

SAP will pay:

9% into the pension - £300 per month.

If you are also personally contributing to the pension then SAP passback 7% of what you pay as an additional employer contribution. This NI passback is because your personal pension contributions are deducted via salary sacrifice. So if you pay £166.66 into the pension, SAP will add in a further £11.67. This means a total of £478.33 will be paid into your pension each month.

Since April 2015 you have more choice as to how you take your pension savings, very briefly they are:

- Take your entire fund as a cash lump sum – up to 25% of this amount will be tax-free, the remainder will be taxed at your marginal rate. You can use this cash in any way you want – you may choose to invest it to boost your income in retirement or set it aside for a rainy day. Whatever your plans, it’s entirely up to you to decide how to use the cash.

- Take your entire fund as a series of cash lump sums – for each sum, 25% can be taken tax-free and the remainder taxed at your marginal rate.

- As before, take up to 25% of your fund as tax-free cash and use the remainder to purchase an annuity.

- Take up to 25% of your fund as tax-free cash and invest the remainder in a ‘drawdown’ product, which allows you to keep your money invested in a tax-exempt environment and draw an income periodically by cashing in part of your fund.

- Alternatively, if your total funds under the scheme are less than £10,000 and you are at least age 55 you may be able to draw your entire fund as cash. This can apply to up to three separate personal pension schemes and 25% of the payment would normally be tax-free.

An annuity is an income payable for life that you buy with your pension savings from an insurance provider.

You can use your entire fund to buy an annuity, or take up to 25% of your savings as a tax-free lump sum and use the rest to buy an annuity.

You’ll have lots of choices when it comes to buying an annuity, such as:

- Which insurance company you choose

- Whether you want to leave your dependants a pension if you die before them

- Whether you want a flat rate income or whether you want it to increase every year

There are many other factors to consider, and they will all affect how much you’ll get when you retire, so it’s important that you think carefully about what you need. Also, please think seriously about taking independent financial advice before you make any decisions; you can find an independent financial adviser in your area at https://www.moneyadviceservice.org.uk/en/articles/choosing-a-financial-adviser.

You can use your pension savings to buy an annuity once you reach 55 (currently the earliest retirement age) unless you become seriously ill.

If you want the security of an income, but the flexibility of taking lump sums when you need them, you can take a mixture of options when you retire.

For example, you could use some of your savings as a cash lump sum, take some to buy an annuity that will provide a secure income for life, and use the rest to transfer to another pension provider to provide drawdown lump sums as and when you need them.

You can take your pension savings from age 55 (currently the earliest retirement age) unless you become seriously ill.

If you leave SAP’s employment, or decide to leave the pension scheme, you have the option of moving your pension savings to another pension arrangement. You’ll be given full details of your options at the time you leave.

Continue to pay contributions to the SAP plan from your own bank account and join your new employers’ arrangement.

Scottish Widows will write to you about 6-8 weeks after you leave SAP to give you information about your options. If you contact their customer service desk on 0345 755 6557 or send an online enquiry where they will send you a Direct Debit mandate to complete.

Transfer the proceeds of your SAP plan into your new UK employer’s scheme.

If you choose this option, you will need to liaise with the provider of your new employer’s scheme.

Do nothing and leave the SAP plan with Scottish Widows.

It will still participate in the funds you have selected and you can register to access Scottish Widow’s member site rather than the SAP portal to access details of your pension online. You will also still benefit from the low annual management charge you have as an SAP plan member. We suggest you seek advice from a professional financial adviser before making any decisions.

In any event please ensure Scottish Widows have up to date instructions as to who you would like your pension fund to go to in the event of your death. As you are leaving SAP any instructions you may have completed on the SAP benefits site will no longer remain recorded.

It is important to ensure that in the event of your death the value of your pension can be paid to your nominated beneficiary/ies direct by Scottish Widows as Trustees & Scheme Administrator. Your nomination form directs them as to who they should use their discretion to pay. As Trustees/Scheme Administrators Scottish Widows can pay the value of your fund without waiting for your estate to be settled.

If it is paid direct to your beneficiaries the fund value can be excluded from the value of your estate for inheritance tax purposes. The nomination form is here. Please complete this form and return it to Scottish Widows ASAP. They will be guided by your latest dated form.

Further information is available here.

Please contact Scottish Widows on 0345 755 6557 (Mon-Fri 10am-4pm) if you have any queries regarding this.

You can start to withdraw your pension savings from age 55. This is currently the earliest age, unless you become seriously ill. This minimum retirement age will be increasing and will always be ten years before state retirement age.